IN THIS SECTION

CFPB Report: 2013-AE-C-021 December 16, 2013

The CFPB Should Reassess Its Approach to Integrating Enforcement Attorneys Into Examinations and Enhance Associated Safeguards

available formats

-

Executive Summary:

PDF | HTML -

Full Report:

PDF (3 MB) | HTML - Accessible version

Finding 1: The CFPB Did Not Consistently Execute Its Integrated Approach in Accordance With the Broad Expectations Outlined in the Examination Support Policy

Supervision and enforcement staff's understanding and execution of the principles outlined in the examination support policy varied considerably. In addition, in some cases supervision and enforcement staff delivered inconsistent messaging to supervised institutions about the role of enforcement attorneys in examinations. We attribute these inconsistencies to multiple causes. First, CFPB supervision and enforcement staff exhibited varying levels of awareness of the examination support policy and did not receive formal training on this policy. Second, the policy outlines general principles regarding the agency's integrated approach but does not sufficiently describe how the approach should be implemented. In our opinion, the inherent risks associated with staffing a relatively new agency and the CFPB's regional operating model further underscore the need to clearly define expectations for staff to ensure consistent execution of supervision activities in accordance with management's expectations. The inconsistent execution of the integrated approach could expose the CFPB to reputational risk, which could potentially undermine any benefits to be derived from the integrated approach.

Establishing Clear Expectations Regarding the Integrated Approach Increases the Likelihood of Its Effective and Consistent Implementation

To execute its supervisory activities, the CFPB, as a relatively new agency, hired examiners with diverse backgrounds and experience levels. The varied prior experience of examiners increases the risk that they may not execute the integrated approach in accordance with management's expectations in the absence of clear guidance and effective training. Further, the CFPB employs a regional operating model to execute its supervisory activities. Each of the agency's four regional directors is responsible for leading several assistant regional directors, field managers, and a staff of over 100 examiners. The CFPB did not establish clear expectations regarding the integrated approach and did not reinforce those expectations via formal training. In our opinion, providing staff clear guidance and effective training on the integrated approach increases the likelihood that staff in different regions will execute the approach consistently.

Supervision and Enforcement Staff's Awareness of the Examination Support Policy Varied

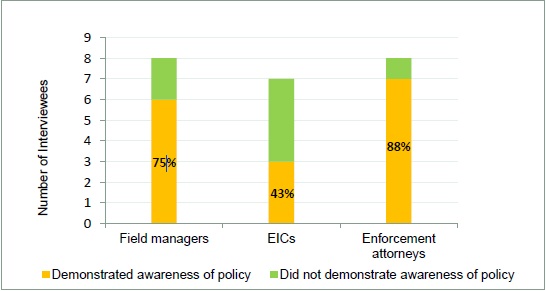

On February 1, 2012, the CFPB issued the examination support policy, which addressed the agency's approach to integrating enforcement attorneys into the examination process. Of the 23 field managers, EICs, and enforcement attorneys we interviewed, approximately 70 percent demonstrated an awareness of the policy. Figure 2 illustrates their respective awareness of the policy. EICs exhibited the lowest awareness rate; less than half of the EICs we interviewed were aware of the policy. Several interviewees noted that they were not aware of the examination support policy or were unsure whether they had received it. One interviewee indicated that the policy "sounds familiar," but noted that he was not certain whether he had read it.

Figure 2: Interviewees' Awareness of the Examination Support Policy

Source: CFPB staff's responses during OIG interviews.

We asked interviewees to describe how the CFPB disseminated the examination support policy to staff. Some individuals indicated that they received the policy via e-mail or during a meeting. A senior official noted that the CFPB distributed the policy to field managers, but the official was not certain that all examination staff received it and acknowledged that it could have been better distributed. One interviewee noted that it generally can be difficult to find CFPB policies and procedures. Further, one senior official noted that it is sometimes a challenge to ensure that those hired after the policy's issuance are aware of it.

We also asked interviewees whether the CFPB delivered any training to accompany the examination support policy. In response, a field manager indicated that he did not remember any formal instruction on this topic, but he noted that "the CFPB had regional conferences and an annual national conference in DC, where these things were discussed." An enforcement attorney noted that "enforcement held ‘all-enforcement-staff meetings' where they discussed the enforcement attorneys' support role"; however, he did not recall receiving any formal training on the integrated approach.

Supervision and Enforcement Staff's Understanding and Execution of the Examination Support Policy Varied

According to the examination support policy, the EIC should engage the assigned enforcement attorney during the scoping, fieldwork, and report drafting phases of the examination. Nevertheless, interviewees noted variation in the enforcement attorneys' involvement during each of these phases.

Scoping

In preparation for an examination, supervision staff perform scoping activities, which include data gathering, drafting a scope summary, and conducting preliminary meetings with the institution under examination. According to the examination support policy, EICs should ensure that the assigned enforcement attorney participates in early scoping discussions and attends the preliminary meetings in which the attorney's role on the examination is explained to the institution. The policy does not specify, however, what should be communicated to institutions regarding the role of enforcement attorneys on examinations.

Despite the guidance concerning enforcement attorneys' expected participation in scoping, their involvement in this phase varied considerably. Several interviewees noted that enforcement attorneys were involved in scoping activities, while others informed us that they were not. While the examination support policy notes that the enforcement attorney should attend the preliminary meetings with the institution, interviewees informed us that enforcement attorneys did not always attend such meetings.

We also identified some variation in the message communicated to supervised institutions regarding the role of the enforcement attorney in the examination. In accordance with the examination support policy, several interviewees noted that they communicated the enforcement attorney's role to the institution at the preliminary meeting or via an earlier communication. Several interviewees stated that they informed institutions that the enforcement attorney provides support or guidance to the examination team on legal issues. CFPB staff also noted that the enforcement attorneys' participation was not necessarily an indication that an enforcement action was imminent. One examiner, however, indicated that he informs supervised institutions that enforcement attorneys attend examinations to obtain training on the supervision process. Specifically, this individual noted that he communicates that the enforcement attorneys are "there for observational purposes, to obtain some cross-training on supervision, and occasionally to provide assistance to the exam team." In one instance, an enforcement attorney informed us of his own understanding that "enforcement attorneys were part of the examination for cross-training purposes, to understand what supervision does, how they work, and their examination process." However, multiple field managers indicated that they did not inform the institutions that attorneys were participating for such purposes, but instead communicated that they were participating to provide support to the examination team.

We learned that senior SEFL management and the CFPB's Legal Division approved a set of talking points for CFPB staff to use when communicating with institutions about the integrated approach. One interviewee informed us that he "received guidance on talking points to use when explaining the role of enforcement attorneys to institutions"; however, three of the CFPB's four regional directors noted that they were not aware of such talking points. In our opinion, variability in messaging and in disseminating talking points to relevant staff may lead to an inconsistent experience among supervised institutions and may also lead to examination teams not operating in accordance with CFPB management's expectations.

Overall, we learned that enforcement attorneys did not always participate in the scoping phase, or in the preliminary meetings with supervised institutions. Further, we identified variation in the message communicated to institutions regarding the role of enforcement attorneys in the examination. In our opinion, this variation demonstrates the inconsistencies in staff's understanding and execution of the policy.

Fieldwork

During the fieldwork phase, supervision staff conduct examination procedures, which may include interviews, transaction testing, or other activities. While not specifically noted in the policy, we understand that aspects of fieldwork can be performed onsite and offsite. According to the examination support policy, the EIC is expected to keep the assigned enforcement attorney apprised of the progress of the examination and of any issues that arise, and the EIC is also expected to hold a midpoint conversation with the enforcement attorney to evaluate the examination's direction. The examination support policy does not specify (1) whether the enforcement attorney should join the examination team during the onsite examination activities or (2) the activities in which the enforcement attorney is expected to be involved.

Our interviews revealed considerable variability in the level of participation of enforcement attorneys in onsite examination activities. A field manager informed us that supervised institutions are often suspicious of enforcement attorneys' involvement in examinations, and in some cases, involved their own legal counsel in meetings with CFPB staff. Several CFPB supervision staff acknowledged that the enforcement attorneys' onsite presence can create a "chilling effect." Accordingly, interviewees expressed concerns that institutions may seek to limit the examination team's access to information, which could hamper the effectiveness of supervisory efforts unless full access is ultimately granted. A field manager indicated that due to such issues, he generally tries to "limit the participation of enforcement attorneys on exams," and prefers to "keep them behind the scenes."

However, a senior CFPB official stated that "some attorneys have indicated a desire to be onsite more . . . to observe the examination process, participate in examination work, and interview management," noting that "their presence can really enhance the examiners' interviews and work onsite." In another example, an examiner noted that an enforcement attorney performed examination procedures on a particular examination and opined that it is "mutually beneficial if enforcement attorneys are on site at examinations and assist with performing examination modules."17 However, a senior official within the Office of Supervision Examinations stated that enforcement attorneys should not be performing examination modules.

The enforcement attorneys' varying involvement during the fieldwork phase of examinations demonstrates the differences in staff's understanding and also illustrates the inconsistent execution of the examination support policy. Further, staff's differences of opinion on key topics such as the value of having the enforcement attorneys participate in onsite examination activities reinforces the need to resolve this issue by clarifying the policy.

Reporting

At the conclusion of the fieldwork phase, the examination team drafts a report to communicate the examination findings to the supervised institution. According to the examination support policy, the EIC will ensure the enforcement attorney's participation in the development of the examination report, especially as it relates to identifying any legal violations and determining appropriate remedies.

We found, however, that supervision personnel had varied understandings of when and how to involve enforcement attorneys in the report development process. An interviewee noted that confusion has arisen between examination staff and enforcement attorneys concerning who is responsible for drafting certain types of supervisory documents. Another interviewee noted that "it would be better for both supervision and enforcement if everyone's roles were more defined and clear." A senior official indicated that examiners should not share draft examination reports with enforcement attorneys until those materials are approved by CFPB regional management. However, another senior official indicated that he encourages examiners to share draft reports with enforcement attorneys prior to review by regional management. These varying interpretations of how and when enforcement attorneys should be involved in the report development process further demonstrate the differences in supervision personnel's understanding and execution of the examination support policy.

Enforcement Attorneys' Respect of the "Primacy of Supervision" Varied

A key concept noted in the examination support policy is that enforcement attorneys shall respect the "primacy of Supervision" by being "careful not to interfere with the Supervision chain of command." However, the policy does not clearly articulate how this concept should be applied in practice. Several supervision and enforcement staff acknowledged that supervision is expected to drive the examination process. In addition, some staff highlighted examples in which the supervision and enforcement staff collaborated effectively. Other interviewees, however, informed us of several situations in which enforcement attorneys did not appear to follow the intent of the "primacy of Supervision" concept noted in the policy.

A senior official noted examples of enforcement attorneys submitting requests for documentation directly to the supervised institution, instead of working through the examination team. The official noted that the requests were either duplicative of existing requests or outside the examination scope, which made the examination team appear fragmented. An interviewee noted that the CFPB should "continue to clarify the enforcement attorney's role on the examination and advise that enforcement attorneys should not try to drive the examination." According to another interviewee, one enforcement attorney drafted an enforcement action and escalated it to CFPB senior management for review without the knowledge of the examination team. The interviewee opined that the attorney's conduct did not adhere to the "primacy of Supervision" concept noted in the examination support policy. These examples reinforce the need for training on this key concept and the need to further delineate management's expectations for acceptable and effective collaboration.

Conclusion

We found that supervision and enforcement staff exhibited varying levels of awareness of the examination support policy and did not receive formal training on the policy. In addition, the policy does not sufficiently detail how the integrated approach should be implemented. As a result, supervision and enforcement staff's understanding and execution of the principles outlined in the policy varied considerably. Further, in some cases, examiners appeared to have delivered inconsistent messages to supervised institutions about the role of enforcement attorneys in examinations, specifically with regard to whether attorneys were involved in examinations for training purposes.

Recommendations

We recommend that the Deputy Director and Associate Director for SEFL

- Determine the appropriate level of enforcement attorney integration into examinations by reassessing the potential risks associated with the practice against the potential benefits, and document the results of the assessment.

-

Develop an updated policy and accompanying operating procedures that align with the agency's intended level of enforcement attorney integration in the examination process. Specifically, the CFPB should define

- the roles and responsibilities of examination staff and enforcement attorneys with precision and clarity.

- expectations regarding enforcement attorneys' potential involvement during each examination phase, including their involvement in supervisory activities, such as performing examination modules, drafting supervisory documents, and obtaining information from institutions.

- the information that should be communicated to institutions concerning enforcement attorneys' role in the examination process.

- the "primacy of Supervision" concept, which may include establishing protocols for managing documentation requests and communications with the institution.

- Ensure that all relevant staff receive the updated policy and accompanying operating procedures, as well as formal training on those materials.

Management's Response

Regarding recommendation 1, the Deputy Director and Associate Director for SEFL stated the following:

We concur with this recommendation, and the CFPB is addressing the concerns raised in this recommendation through its new policy on enforcement attorney integration into examinations. Throughout much of the past year, CFPB has been engaged in a comprehensive reassessment regarding the appropriate level of enforcement attorney integration into examinations. In December 2012, the CFPB's Division of Supervision, Enforcement, and Fair Lending and Equal Opportunity (SEFL) convened a working group to review existing CFPB policy regarding the integration of enforcement attorneys into CFPB examinations. The working group consisted of members from all SEFL offices, including a mix of Headquarters and field staff. The group met regularly to evaluate existing practices and discuss potential issues and solutions. The group also solicited oral feedback internally from each SEFL office and SEFL management and externally with more than 20 Chief Compliance Officers of major financial institutions.

Through this process, we determined that by discontinuing CFPB enforcement attorneys' involvement in on-site examination activities generally, and by clarifying enforcement attorneys' role in examination support, we would achieve greater efficiency and more capacity in all offices. On October 7, 2013, CFPB formally announced a new policy implementing these changes. This policy will be effective nationally, and will be implemented in CFPB headquarters operations as well as in each CFPB region.

Regarding recommendation 2, the Deputy Director and Associate Director for SEFL stated the following:

We concur with this recommendation, and the CFPB is addressing the concerns raised in this recommendation through its new policy on enforcement attorney integration into examinations. On October 7, 2013, the CFPB formally announced its new policy. This policy defines roles and responsibilities for enforcement attorneys, examiners, and the SEFL offices; expectations regarding enforcement attorney support of CFPB examination activities; and protocols for managing documentation requests and communications with supervised entities. We also are developing consistent messaging for CFPB staff to communicate the new policy to supervised institutions as needed. In addition, CFPB is drafting additional operating procedures to implement the new policy. These operating procedures will contain appropriate monitoring and reporting requirements and other internal controls to facilitate the oversight of the effectiveness of the new policy.

Regarding recommendation 3, the Deputy Director and Associate Director for SEFL stated the following:

We concur with this recommendation, and the CFPB is addressing the concerns raised in this recommendation through its new policy on enforcement attorney integration into examinations. Since adopting the new policy, the CFPB has conducted a series of seven training sessions, some live and some online via webinar. These sessions were mandatory for all SEFL staff. The CFPB also made available the training materials and a recording of one of the trainings to all SEFL staff on the CFPB Intranet. Staff who could not attend a training session were required to listen to the recording and certify that they had received training. As of Friday, November 15, 2013, 578 SEFL staff members, out of a total of 619 (or approximately 93 percent), had completed this mandatory training. New hires will receive appropriate training on the policy as part of the orientation process.

Once appropriate additional operating procedures with respect to the policy have been finalized, CFPB will ensure that all applicable CFPB staff receive appropriate formal training on those procedures, as well.

OIG Comment

In our opinion, the actions described by the Deputy Director and Associate Director for SEFL appear to be responsive to our recommendations. We plan to follow up on the CFPB's actions to ensure that each recommendation is fully addressed.

- 17. Examination modules consist of detailed steps for examiners to perform in order to assess specific aspects of the supervised entity's operations. Return to text