IN THIS SECTION

Board Report: 2014-SR-B-011 July 25, 2014

Enforcement Actions and Professional Liability Claims Against Institution-Affiliated Parties and Individuals Associated with Failed Institutions

available formats

-

Results in Brief

HTML -

Full Report:

PDF (2 MB) | HTML - Accessible version

Background

Section 8 of the FDI Act grants authority to the Regulators to impose formal EAs against IAPs and depository institutions. Each of the Regulators has enforcement units within their legal divisions that administer and develop EAs against IAPs. These enforcement units work closely with risk management examiners to develop evidence to support EAs. The Regulators have jurisdictional authorities as follows:

- The FDIC is authorized to impose EAs against IAPs of state-chartered institutions that are not members of the Federal Reserve System. There were 289 failed state nonmember institutions within the scope of our review. The FDIC, as insurer, is also authorized to use its back-up enforcement authority under certain circumstances to impose EAs against IAPs of any insured depository institution.

The FRB is authorized to impose EAs against IAPs of state-chartered institutions that are members of the Federal Reserve System and bank holding companies.5 There were 49 failed state member institutions supervised by the FRB within the scope of this review.

- The OCC is authorized to impose EAs against IAPs associated with (1) national banks, (2) federal branches and agencies of foreign institutions, and (3) federally chartered savings associations and their subsidiaries. There were 79 failed national banks within the scope of our review.

The FDIC's PLU is responsible for the FDIC's Professional Liability Program. PLU and DRR investigate every institution failure and pursue PLCs that are both meritorious and expected to be cost-effective.

The FDIC's PLU was formed in 1989 and the FDIC's authority to pursue PLCs comes from requirements in the FDI Act to maximize recoveries from receivership assets.

The 2008 Financial Crisis

Following years of poor underwriting practices and aggressive growth, the residential and commercial real estate markets declined significantly in 2007, setting off a string of events that led to a full-blown financial crisis. The 2008 financial crisis resulted in the collapse of large entities such as Lehman Brothers, necessitated government assistance to other institutions, and led to the failure of 465 institutions through December 31, 2012, and associated DIF losses of $86.6 billion.

When an institution's failure results in a material loss to the DIF, the FDI Act requires the appropriate Inspector General to conduct an MLR to determine the cause of the failure and assess the regulator's supervision of the institution. Many of our MLRs concluded that management did not operate institutions in a safe and sound manner, which contributed to institution failures. Table 1 depicts the number of failed institutions and MLRs conducted.

Table 1: Institution Failures: 2008-2012

|

Year |

FDIC |

FRB |

OCC |

OTS |

Total |

|

2008 |

14 |

1 |

5 |

5 |

25 |

|

2009 |

79 |

16 |

25 |

20 |

140 |

|

2010 |

99 |

17 |

23 |

18 |

157 |

|

2011 |

64 |

11 |

12 |

5 |

92 |

|

2012 |

33 |

4 |

14 |

0 |

51 |

|

Total |

289 |

49 |

79 |

48 |

465 |

|

(96 MLRs) |

(23 MLRs) |

(53 MLRs)* |

(172 MLRs) |

||

Source: Analysis of information obtained from the FDIC's Division of Finance.

* The 53 MLRs covered 26 OCC supervised institutions and 27 OTS-supervised institutions. Return to text

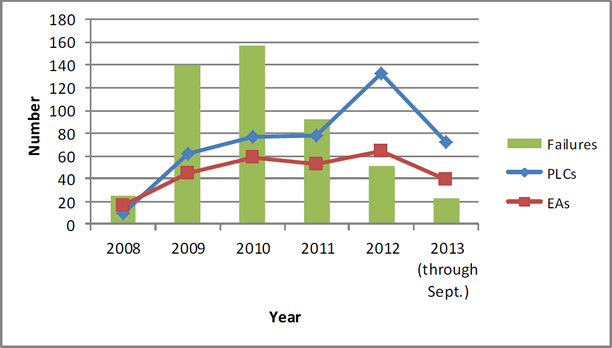

Consistent with the increase in failures, and starting in 2009, there was an increase in the number of issued EAs and completed PLCs. The increase in EAs and PLCs lagged behind the increase in institution failures due to the amount of time that it takes to investigate and process these actions. Figure 1 presents statistics on the number of institution failures and number of EAs and PLCs associated with failed institutions.

Figure 1: Institution Failures, EAs Issued, and PLCs Completed

Source: FDIC OIG analysis of FDIC, FRB, and OCC data.

Note: An EA typically pertains to one individual but sometimes multiple individuals.

A PLC typically pertains to multiple individuals and entities.

- 5. The FRB also has authority to impose EAs against IAPs of nonbank subsidiaries of bank holding companies, Edge Act and agreement corporations, and certain foreign banking organizations. Return to text