IN THIS SECTION

Board Report: 2014-FMIC-B-014 September 30, 2014

Opportunities Exist to Enhance the Onsite Reviews of the Reserve Banks’ Wholesale Financial Services

available formats

-

Executive Summary:

PDF | HTML -

Full Report:

PDF | HTML - Accessible version

Introduction

Objectives

The Federal Reserve System comprises the Board of Governors of the Federal Reserve System (Board) and the 12 Federal Reserve Banks (Reserve Banks). As the central bank of the United States, part of the Federal Reserve System’s mission is to maintain the stability of the nation’s financial system and contain systemic risk that may arise in financial markets.

The Reserve Banks provide retail1 and wholesale2 financial services to participants that include depository institutions, the U.S. government, and foreign institutions. These services include key wholesale payment and settlement systems identified as financial market infrastructures (FMIs).3 FMIs are the backbone of the global financial system and, if not properly managed, can be sources of shock to domestic and international financial markets. As such, our audit focused on the Reserve Banks’ wholesale financial services.

The Board’s Division of Reserve Bank Operations and Payment Systems (RBOPS) is responsible for overseeing the policies and operations of the Reserve Banks. Our objective for this audit was to assess the extent and effectiveness of RBOPS’s oversight of the Reserve Banks’ wholesale financial services. Our scope and methodology are detailed in appendix A.

Background

Wholesale Financial Services

Wholesale financial services include payment and settlement systems that facilitate the exchange of payments and the settlement of transfers of funds or financial instruments. The Reserve Banks operate three wholesale payment and settlement systems: the Fedwire Funds Service, the Fedwire Securities Service, and the National Settlement Service (NSS). These services enable their participants to transfer funds, record book-entry securities,4 and settle obligations. As depicted in table 1 below, the Reserve Banks’ wholesale financial services involve trillions of dollars and thousands of financial institutions each day.

Table 1: Federal Reserve System Wholesale Financial Services Statistics

| Service | Participants | Average number of transfers/day | Average value/day |

|---|---|---|---|

| Fedwire Funds | 6,500 customers | 535,000 | $2.8 trillion |

| Fedwire Securities | 5,500 active customers | 76,000 | $1.2 trillion |

| NSS | 17 settlement arrangements | 40 settlement files | $69 billion |

Source: OIG compilation based on information on the Board’s public and internal websites.

Note: Figures represent the annual average in 2013.

Fedwire Funds Service

The Fedwire Funds Service settles payments that typically are large in value and time critical. The Fedwire Funds Service processes funds transfers immediately upon receipt. Once processed, payments are final and irrevocable. Participants in the Fedwire Funds Service send and receive payments through a master account held with a Reserve Bank. These funds transfers are highly concentrated, with the top 10 participants accounting for approximately 70 percent of the total value.

Fedwire Funds Service participants submit transfer instructions either online or offline. The Fedwire Funds Service processes online transfer instructions without manual intervention; offline participants submit instructions by calling the Reserve Banks’ Wholesale Operations Site. Offline participants pay more because their transactions are processed manually.

Fedwire Securities Service

The Fedwire Securities Service transfers, settles, and maintains securities issued by the U.S. Treasury, federal government agencies, government-sponsored enterprises, and some international organizations. The Fedwire Securities Service manages electronic transfer of book-entry securities between participants and processes settlements in accounts held on the books of the Reserve Banks. The Fedwire Securities Service also maintains electronic storage of securities records and processes principal and interest payments.

Fedwire Securities Service transactions are also highly concentrated; the top 25 participants generate more than 90 percent of the volume and value. In particular, transactions by the top 2 participants account for over 60 percent of the volume and value transferred across the Fedwire Securities Service. Fedwire Securities participants submit transfer instructions in the same manner as Fedwire Funds participants.

National Settlement Service

The NSS facilitates settlement for private-sector groups, such as check clearinghouse associations and automated clearinghouse networks. Multiple parties participate in settlement arrangements processed by the NSS. A single settlement agent from a group submits a settlement file on behalf of the group participants to the NSS. The NSS settles participant accounts at the Reserve Banks per instructions in the settlement file. The NSS offers an offline service only when a settlement agent’s online transmission is unavailable.

Wholesale Financial Services Management

The Wholesale Product Office (WPO) at the Federal Reserve Bank of New York has management responsibilities for the Reserve Banks’ wholesale financial services and, in this role, sets strategic direction and centrally manages wholesale operations. The WPO also ensures Reserve Bank compliance with its standard operating procedures, and it receives application development, audit, legal, and research support from the Federal Reserve Bank of New York.

Wholesale Operations Sites, located within certain Federal Reserve Banks, support wholesale financial services through a split operations program in which each responsible location routinely supports the others’ offline transactions and also provides backup for system resilience. These split operations are designed to appear seamless to customers.

The Central Electronic Payment Systems Central Business Administration Function monitors day-to-day operations of wholesale financial services to ensure their safety and soundness. The Central Electronic Payment Systems Central Business Administration Function schedules, tests, and authorizes changes to the production and test systems. It also ensures the availability of the Fedwire Funds Service, the Fedwire Securities Service, and the NSS according to business requirements and service agreements.

Wholesale Testing Units support the depository institution testing environments in which developers test applications such as future releases and emergency fixes. The Wholesale Testing Units also train new Fedwire customers, troubleshoot, and perform contingency tests.

Wholesale Financial Services Guidance

Multiple rules and regulations govern the Reserve Banks’ wholesale financial services. The WPO sets forth its standard operating procedures, which are guidelines for the management, administration, and operations of wholesale financial services. The Reserve Banks’ operating circulars5 also provide the legal terms for, and govern the use of, Reserve Bank financial services. Wholesale financial services are subject to additional standards and supervision as discussed below.

The management and operations of the Reserve Banks’ wholesale financial services are guided by the risk-management policies in the Federal Reserve Policy on Payment System Risk (PSR policy). The Board developed the PSR policy to ensure the safety and efficiency of payment and settlement systems. The PSR policy applies to payment and settlement systems, such as the Reserve Banks’ wholesale financial services, that are expected to settle a daily aggregate value of U.S. dollar–denominated transactions exceeding $5 billion on any day during the following 12-month period. The PSR policy incorporates international principles that emphasize an effective risk-management framework, including (1) clear identification of risks, (2) sound governance, (3) clear and appropriate rules and procedures, and (4) employment of the necessary resources. The WPO follows the PSR policy in its management of wholesale financial services.

The Board has published for comment revisions to its PSR policy. These revisions closely align with the proposed enhanced standards for Board-supervised private-sector financial market utilities (FMUs)6 designated as systemically important by the Financial Stability Oversight Council7 under Title VIII of the Dodd-Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank Act), entitled the Payment, Clearing, and Settlement Supervision Act of 2010. The purposes of Title VIII are to mitigate systemic risk in the financial system and to promote financial stability through enhanced supervision of designated FMUs. Although only designated FMUs are subject to provisions of Title VIII, the Board, in a July 2012 press release, recognized the vital role that Fedwire services play in the U.S. financial system. In that statement, the Board reaffirmed that it holds Fedwire services to supervision standards that are comparable to or that exceed those for designated FMUs.

Oversight of the Federal Reserve Banks’ Wholesale Financial Services

The Federal Reserve System plays an important role in the nation’s payment systems by providing wholesale financial services to depository institutions. Participants use the Federal Reserve’s wholesale financial services to exchange an average daily value of approximately $4 trillion. Multiple parties within the Federal Reserve System, as described below, are involved in the oversight of wholesale financial services. Those parties routinely scrutinize the operations and risk-management practices of wholesale financial services to ensure their safety and effectiveness.

RBOPS is responsible for the oversight of Reserve Bank operations, including overseeing and monitoring various aspects of wholesale financial services. Within RBOPS, the Oversight Program Management group is responsible for the overall onsite review process for the Reserve Banks. As such, the Oversight Program Management group coordinates onsite reviews with respective Reserve Bank operations as well as with sections within RBOPS.8 The FMI Oversight group within RBOPS supports the Board in meeting its statutory responsibilities under the Federal Reserve Act9 for oversight of the Reserve Banks’ wholesale financial services, as well as under Title VIII of the Dodd-Frank Act for supervision of the private-sector FMUs designated as systemically important.

Within the FMI Oversight group, the wholesale oversight team10 oversees the Reserve Banks’ wholesale financial services and works closely with officials and staff at the WPO to continuously monitor activities and conduct onsite reviews.11 The wholesale oversight team communicates frequently with the WPO, performing ongoing monitoring through monthly calls to discuss current issues, receiving status updates on operations and weekly status reports for certain projects, and holding ad hoc teleconferences. These communications are intended to enable the oversight team to gain critical knowledge of the WPO’s management and operations of wholesale financial services. In addition, the team has an annual supervisory plan for its reviews of wholesale financial services. These oversight activities are conducted in close coordination with other responsible parties. As an example, the Information Technology section within RBOPS participates in the oversight of wholesale financial services. The Reserve Banks’ General Auditors also conduct audits on wholesale financial services at their respective Reserve Banks.

Reviews of Wholesale Financial Services

The oversight of wholesale financial services has evolved to reflect the changing environment of payment, clearing, and settlement systems. The Board’s decision to align its supervision of the Fedwire services with that of designated FMUs resulted in changes to the wholesale oversight team’s approach in its supervision of Fedwire services. For example, historically, reviews of wholesale financial services were conducted as a part of the triennial geographical review of the relevant Reserve Bank. The FMI Oversight group now carries out annual reviews of wholesale financial services to align with the Title VIII requirement that supervisory agencies conduct annual examinations of designated private-sector FMUs. These reviews assess functions of wholesale services, regardless of where the particular functions are performed, and may involve more than one Reserve Bank.

Review Planning

The wholesale oversight team employs a risk-based planning process to identify risks in the operation and governance of wholesale financial services, which is consistent with the process examiners use to supervise private-sector FMUs. The team uses this process to (1) identify areas of supervisory focus and (2) prioritize and organize those areas into supervisory activities. The process incorporates the risk-management framework from the PSR policy and international principles. The team employed this process to plan its onsite review schedule for 2012 and 2013.

Review Processes

After identifying areas of supervisory focus and corresponding objectives and review plans, the wholesale oversight team works with the RBOPS Oversight Program Management group in preparing and conducting onsite reviews. The Oversight Program Management group is responsible for the overall review process and coordinates review logistics with Reserve Banks as well as other RBOPS review teams that conduct reviews of different business areas.

The wholesale oversight team obtains necessary information in advance to plan its onsite review procedures. Once onsite, the team spends about a week conducting its review. While onsite, the wholesale oversight team meets regularly with Reserve Bank staff members to discuss the status of the review. Additionally, the team holds a status meeting at the conclusion of its onsite visit and provides observation bullet points.

After the onsite visit, the wholesale oversight team completes its review and drafts a report. Each team member drafts his or her review section. The team then compiles the sections into one draft and submits the draft to FMI Oversight management. After management’s review, the draft is submitted to the Oversight Program Management group. The Oversight Program Management group combines drafts from the wholesale oversight team and other RBOPS review teams that conducted their reviews concurrently.

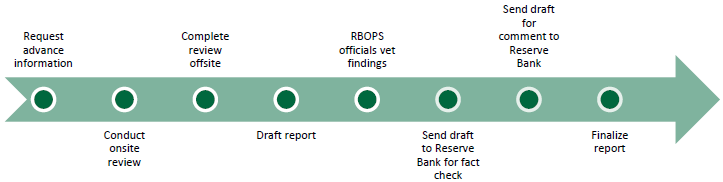

The Oversight Program Management group schedules a senior management meeting with RBOPS officers, managers, project leaders, and some team members to discuss review findings. Each review team presents its review results and findings in the meeting, and senior management assesses the team’s work and the resulting findings. Based on the results of the meeting, the review team will update or revise the findings as necessary. After Reserve Bank officials conduct a fact-checking review of the initial draft report, the Oversight Program Management group sends the official draft report to Reserve Bank officials for their review and finalizes the report after receiving the Reserve Bank officials’ comments. The review process is depicted in figure 1.

Figure 1: Review Process

Source: OIG generated based on interviews with RBOPS staff and officials.

Review Findings

Review findings are tracked and monitored by multiple parties. Within RBOPS, the Oversight Program Management group is responsible for tracking review findings. The Oversight Program Management group tracks the status of review findings with a system called Issue Tracker. Staff members from the Oversight Program Management group enter review findings into the system and update the information as necessary. Depending on the severity level of findings, either RBOPS or the General Auditor, or both, may follow up on the findings. RBOPS can clear any findings, whereas the General Auditor can only close severity level 2 or 3 findings with RBOPS’s concurrence.12 General Auditors also have access to Issue Tracker and are responsible for reporting the status of the findings to the Oversight Program Management group quarterly. The wholesale oversight team tracks the status of findings through its frequent communication with the WPO and closely monitors the progress of findings resolution.

- 1. Retail payments generally are for relatively small dollar amounts and often involve a depository institution’s retail clients—individuals and smaller businesses. The Reserve Banks’ retail services include collecting checks and electronically transferring funds through the automated clearinghouse system. A clearinghouse is an establishment maintained by banks for settling mutual claims and accounts. Return to text

- 2. Wholesale payments generally are for large dollar amounts and often involve a depository institution’s large corporate customers or counterparties, including other financial institutions. Return to text

- 3. An FMI is a multilateral system for clearing, settling, or recording payments, securities, derivatives, or other financial transactions. Multiple financial institutions participate in a single FMI. Return to text

- 4. Ownership of book-entry securities is not physically transferred but is recorded electronically on the books of the depository institutions where owners maintain accounts. Return to text

- 5. Federal Reserve Bank financial services are governed by the terms and conditions set forth in applicable operating circulars. In particular, Operating Circular 6 applies to funds transfers made through the Fedwire Funds Service, Operating Circular 7 contains the terms of book-entry securities account maintenance and transfer services, and Operating Circular 12 discusses the terms of settlement services through the NSS. Return to text

- 6. FMUs are multilateral systems that provide the infrastructure for transferring, clearing, and settling payments, securities, and other financial transactions among financial institutions. The terms FMU and FMI are often used interchangeably. Return to text

- 7. In 2012, the Financial Stability Oversight Council designated eight private-sector FMUs as systemically important under Title VIII of the Dodd-Frank Wall Street Reform and Consumer Protection Act, titled the Payment, Clearing, and Settlement Supervision Act of 2010. The Board is the supervisory agency for two of these private-sector FMUs. Return to text

- 8. A Reserve Bank review typically includes, among other things, reviews of business areas such as business continuity, cash, human resources, discretionary expenditures, facilities management, financial accounting, and information technology. Return to text

- 9. The Federal Reserve Act authorized and empowered the Board to exercise general supervision over the Federal Reserve Banks. The Board has delegated oversight responsibility to the Director of RBOPS (or the Director’s designee) in certain circumstances. Return to text

- 10. The wholesale oversight team, which consisted of three staff members, had increased to four staff members as of June 2014, after we completed our fieldwork. Return to text

- 11. RBOPS is organized into sections that focus on distinct but related issues that generally align with financial services and support functions at the Reserve Banks, such as information technology, accounting, fiscal agency services, and retail services. Return to text

- 12. See appendix B for the description of the severity levels of review findings. Return to text