IN THIS SECTION

CFPB Report: 2014-SR-C-013 September 29, 2014

The CFPB Complies With Section 1100G of the Dodd-Frank Act, but Opportunities Exist for the CFPB to Enhance Its Process

available formats

-

Executive Summary:

PDF | HTML -

Full Report:

PDF (3 MB) | HTML - Accessible version

Introduction

Objective

Our objective was to evaluate the Consumer Financial Protection Bureau's (CFPB) actions to comply with section 1100G of the Dodd-Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank Act). To accomplish our objective, we reviewed CFPB policies and procedures and other documents applicable to rulemakings under section 1100G of the Dodd-Frank Act.1 We interviewed CFPB staff in the Division of Research, Markets, and Regulations (RMR), and we reviewed a sample of proposed and final rules for compliance with the provisions of section 1100G and other relevant regulatory analysis provisions. Additional details on our scope and methodology are in appendix A.

Background

Title X of the Dodd-Frank Act established the CFPB to "regulate the offering and provision of consumer financial products or services under the Federal consumer financial laws."2 The Dodd- Frank Act authorized the CFPB to prescribe rules and issue orders and guidance concerning federal consumer financial laws. As part of the rulemaking process, federal agencies are required under the Regulatory Flexibility Act, as amended (RFA), to analyze the impact of their regulatory actions on small entities. Section 1100G of the Dodd-Frank Act, which became effective July 21, 2011, amended some of the provisions of the RFA, such as requiring the CFPB to assess the impact of any proposed rule on the cost of credit for small business entities through a regulatory flexibility analysis. This analysis includes assessing alternatives to the proposed rule that accomplish statutory objectives while minimizing the potential increase in the cost of credit for small entities. Section 1100G also requires the CFPB to convene panels to seek direct input from small business entities prior to issuing certain rules. Section 1100G did not include any deadlines or amend any deadlines contained in the RFA.

RMR is responsible for analyzing and drafting rules that may impact small business entities. RMR includes two groups that are primarily involved in the section 1100G rulemaking process: the Office of Research and the Office of Regulations. The Office of Research consists of economists and financial analysts who perform economic research and analysis concerning the impact of the rule, and the Office of Regulations is staffed with attorneys who draft the rulemaking text and work with the CFPB's Office of General Counsel to ensure that the rulemaking process complies with applicable requirements.

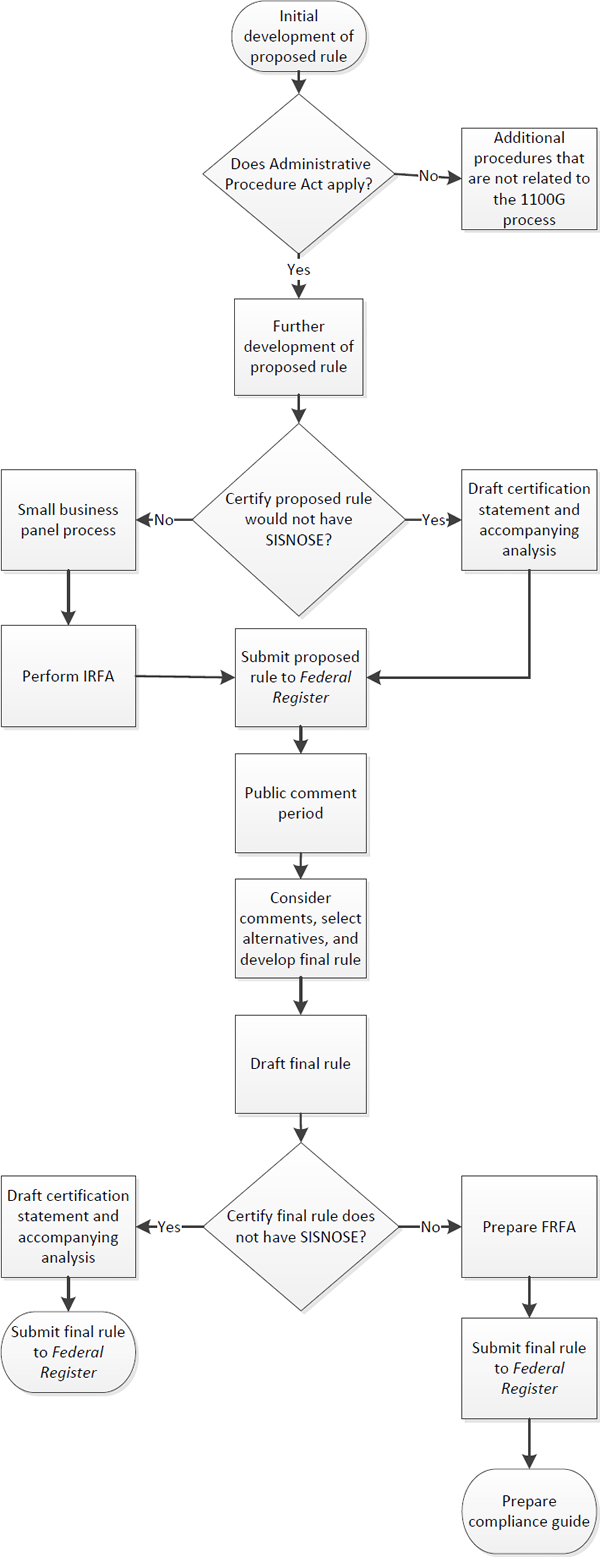

The rulemaking process may require the CFPB to conduct an initial regulatory flexibility analysis (IRFA), as well as a final regulatory flexibility analysis (FRFA). The RFA dictates when the CFPB must provide certain additional information in support of its IRFA on proposed rules and when it must prepare a FRFA on final rules.3

Section 603 of the RFA prescribes the content of an IRFA, which is required for proposed rules issued for public notice and comment in a notice of proposed rulemaking (NPRM) in the Federal Register.4 For an IRFA, the CFPB performs independent analysis on proposed rules, which includes (1) considering any significant alternatives; (2) considering the cost-of-credit impact on small entities;5 (3) under certain circumstances, meeting with a representative set of small businesses in the form of a small business review panel to obtain the panel's advice and recommendations; and (4) publicizing the proposed rule.

As part of the IRFA process, RMR provides small entities an opportunity to participate in the rulemaking process through small business review panels under the framework found in section 609 of the RFA. The CFPB organizes these panels in conjunction with staff at other agencies, including the Small Business Administration's Chief Counsel for Advocacy (SBA Advocacy Counsel) and the Office of Management and Budget's (OMB) Office of Information and Regulatory Affairs. Once convened, the small business review panel identifies representatives of affected small entities and ensures that those representatives have an opportunity to participate and provide advice and recommendations related to the rule. The interagency small business review panel must issue a public report within 60 days of convening based on the comments from the small entity representatives and publish that report when the proposed rule is issued as an NPRM.

An exception to the IRFA process allows the agency head to certify that a proposed rule would not have a significant economic impact on a substantial number of small entities (SISNOSE).6 When a SISNOSE certification occurs, the CFPB generally does not convene the small business review panel, does not conduct the IRFA, and does not describe the cost-of-credit impact associated with the rule.7 SISNOSE certification can occur at various points in the rulemaking process.

Section 604 of the RFA describes the process of promulgating a final rule. If SISNOSE certification does not occur pursuant to section 603, RMR prepares a FRFA and makes it available to the public by publishing it as part of the final rule. For a FRFA, the CFPB performs independent analysis on information obtained during its initial analysis and subsequent comment periods and publicizes the final rule with a description of the steps the agency has taken to minimize any additional cost of credit for small entities. In its FRFA, RMR addresses any significant issues raised during the comment period, discusses any changes to the proposed rule, estimates the number of small entities to which the rule will apply, and describes the steps the CFPB has taken to minimize the significant economic impact on small entities. Ultimately, the final rule is published in the Federal Register.8 Figure 1 provides an overview of the CFPB's section 1100G rulemaking process.

Figure 1: The Office of Inspector General's Depiction of the CFPB's Section 1100G Rulemaking Process

Source: OIG compilation based on documents provided by the CFPB and interviews with RMR officials.

CFPB Internal Guidance

Interim Guidance on Regulatory Analysis for Substantive Rulemakings

In January 2012, RMR issued its Interim Guidance on Regulatory Analysis for Substantive Rulemakings under the Dodd-Frank Act. The CFPB issued the interim guidance, in part, to facilitate the agency's compliance with the regulatory flexibility analysis requirements in the Dodd-Frank Act and the RFA. The interim guidance highlights the need for regulatory analysis in the rulemaking process that considers the costs, benefits, and impact of the regulation and that promotes an efficient and consistent approach to regulatory analysis. The guidance permits staff to "vary materially from the terms of this guidance after appropriate consultation with the Office of General Counsel and notice to the Associate or Deputy Associate Director of RMR."

The guidance establishes RMR as the lead for rulemakings subject to section 1100G and specifies that at least one economist from RMR's Office of Research will participate on a rulemaking team. The regulatory flexibility analyses may be drafted by RMR or any other appropriate office at the CFPB; however, RMR's Office of Research may review and concur, and it is ultimately accountable for the overall analysis.

The interim guidance notes that RMR should determine whether the number of small entities expected to experience a significant economic impact from the anticipated regulation is substantial. If the rule will not have a SISNOSE, a memorandum should be drafted to the Associate Director for RMR that contains the factual basis for the recommendation to certify. The interim guidance then states that the Associate Director for RMR, or other appropriate executive, should present a recommendation to the CFPB Director concerning the agency's assessment to certify.

Interim Guidance on the Small Business Review Panel Process

In February 2012, RMR issued the Interim Guidance on the Small Business Review Panel Process under the Regulatory Flexibility Act, as amended by the Small Business Regulatory Enforcement Fairness Act and the Dodd-Frank Act. The guidance outlines the requirements of the RFA and includes actions that may be taken, such as informal discussions with the SBA Advocacy Counsel and the OMB's Office of Information and Regulatory Affairs, regarding the small business review panel process. Informal discussions include consultations regarding a schedule to convene the panel and hold meetings with small entity representatives.

Among other requirements, the CFPB develops the materials to be distributed to small entity representatives and works with the SBA Advocacy Counsel and OMB's Office of Information and Regulatory Affairs on the following:

- collecting advice and recommendations from the small entity representatives on issues related to the proposed rule and significant alternatives

- issuing a report within 60 days of convening the small business review panel that discusses the comments of the small entity representatives and the panel's findings related to the proposed rule

- waiving the requirements of convening a small business review panel if such requirements would not advance the effective participation of small entities in the rulemaking process

The CFPB's Approach to Addressing Cost of Credit

Sections 603 and 604 of the RFA, as amended by section 1100G of the Dodd-Frank Act, respectively state that the IRFA must consider the cost of credit for small entities and the FRFA must include a description of the steps taken to minimize any additional cost of credit for small entities, unless the CFPB certifies that the rule, if issued, would not have a SISNOSE. These provisions within the RFA only relate to small entities. During the small business review panel process, RMR collects advice and recommendations regarding the potential increase in the cost of credit for small entities and evaluates any potential alternatives. In addition, on a discretionary basis, RMR conducts independent analysis of the projected increase in the cost of credit for small entities. As part of this analysis, the CFPB considers the impact that the rule may have on end-user consumers by estimating which costs will likely be borne by consumers and testing such forecasts with data.

- 1. This report will narrowly refer to rulemaking as only those rulemaking processes related to the provisions within section 1100G of the Dodd-Frank Act. The use of the term rulemaking is not a reference to all notice and comment rulemaking activities. Return to text

- 2. Dodd-Frank Wall Street Reform and Consumer Protection Act, Pub. L. No 111-203, § 1011(a), 124 Stat. 1376, 1964 (2010) (codified at 5 U.S.C. § 5491(a) (2010)). Return to text

- 3. Dodd-Frank Wall Street Reform and Consumer Protection Act, Pub. L. No 111-203, § 1100G, 124 Stat. 1376, 2112-13 (2010) (codified at 5 U.S.C. §§ 603(d), 604(a), 609(d)). Return to text

- 4. The NPRM is the official document that announces and explains the agency's plan to address a problem or accomplish a goal. Proposed rules are published in the Federal Register to notify the members of the public and to give them an opportunity to submit comments. In certain situations, the NPRM must include a description of (1) any projected increase in the cost of credit for small entities, (2) any significant alternatives to the proposed rule that accomplish the stated objectives of applicable statutes and that minimize any increase in the cost of credit for small entities, and (3) the advice and recommendations of representatives of small entities relating to issues associated with the project increases or alternatives. Return to text

- 5. Small entities are defined by the Small Business Administration as small businesses, small governmental units, and small organizations. During the rulemaking period, an entity was considered small by the Small Business Administration if it had $175 million or less in assets for banks and $7 million or less in revenue for nonbank mortgage lenders, mortgage brokers, and mortgage servicers. Return to text

- 6. Section 553(b) of the Administrative Procedure Act and section 608 of the RFA allow for instances in which the regulatory flexibility analysis and small business review panel provisions can be waived. For example, section 553(b) of the Administrative Procedure Act states that a rule does not go out for notice and comment, and therefore would bypass the IRFA and small business review panel, if the rule is interpretative; if the rule is a general statement of policy; if the rule is a rule of agency organization, procedure, or practice; or if the agency for good cause finds (and incorporates the finding and a brief statement of reasons therefore in the rules issued) that notice and public procedure thereon are impracticable, unnecessary, or contrary to the public interest. Section 608 of the RFA allows the Director of the CFPB to provide in writing a justification for waiving or exempting the agency from the regulatory flexibility analysis required in section 603 of the RFA, or a justification for delaying the completion of the RFA requirements in section 604, in response to an emergency. Return to text

- 7. The CFPB may, in some instances, certify that a proposed rule would not have a SISNOSE but continue to evaluate the potential economic impact of the proposed rule on small entities as defined by the RFA. Return to text

- 8. Before the final rule becomes effective, the CFPB issues a small entity compliance guide that highlights issues that small businesses, and those who work with them, may want to consider when implementing the rule. Return to text